Strategic Spin-Offs: Unlocking Value in Global Markets

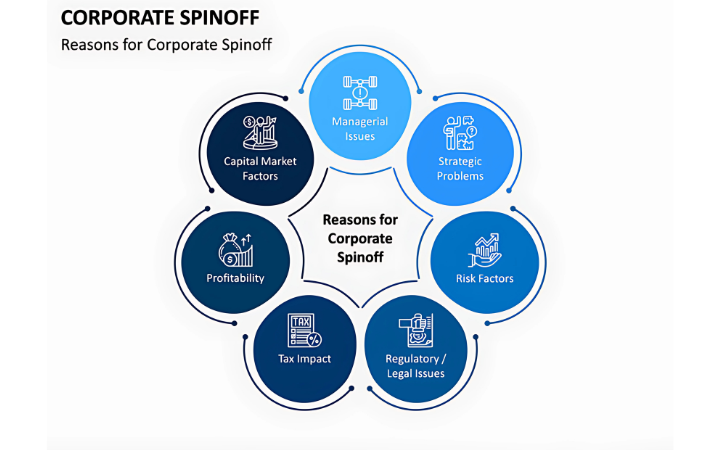

Throughout 2023 and early 2024, strategic spin-offs gained prominence as corporations across industries sought to maximize shareholder value amidst slowing economic growth and evolving investor demands. The tactic allowed companies to streamline operations, improve capital allocation, and highlight the intrinsic worth of underlying business units.

Major conglomerates, particularly in sectors like healthcare, technology, and consumer goods, announced high-profile spin-offs aimed at creating more agile, focused entities better positioned to compete and innovate in their respective markets.

One notable trend was the separation of "growth engines" from slower-moving legacy businesses. By decoupling, companies enabled investors to value high-growth assets without being diluted by mature, capital-intensive segments. This unlocked significant re-rating potential for both parent and spin-off entities.

Activist investors played a critical role in accelerating spin-off activity. Shareholder campaigns emphasized that diversified corporate structures often masked underlying value, and separation could serve as a catalyst for improved governance, operational efficiency, and market valuation.

From a regulatory perspective, jurisdictions including the U.S., Europe, and parts of Asia provided relatively supportive frameworks for spin-off transactions, though antitrust and tax considerations required careful navigation, particularly in cross-border cases.

Despite the strategic benefits, spin-offs also posed challenges. Management teams had to carefully design governance structures for the new entities, align strategic goals, and manage transition risks such as supply chain disruptions, talent retention, and brand dilution.

Looking forward, analysts expect spin-offs to remain a favored strategic tool, particularly as capital markets place an increasing premium on specialization, transparency, and focused innovation in an era of economic and technological transformation.